A LUXURIOUS TORONTO HOTEL

Experience One King West Hotel & Residence, one of Toronto’s most acclaimed boutique hotels, highly regarded for its ambience, luxury amenities and award-winning customer service.

Ideally located in the heart of downtown Toronto at the corner of King and Yonge streets, One King West places you within minutes to downtown financial, entertainment, and shopping districts. Whether in town for a weekend or an extended stay, settle into one of our sophisticated and well-appointed suites located in either our HISTORIC Dominion Bank Building or Toronto’s famous “Sliver” condo TOWER.

With a wide variety of suites to accommodate every need, in addition to some of Toronto’s most beautiful event venues and functional meeting spaces, One King West Hotel & Residence is truly your Hotel to Call Home.

STYLISH & CONTEMPORARY ACCOMMODATIONS

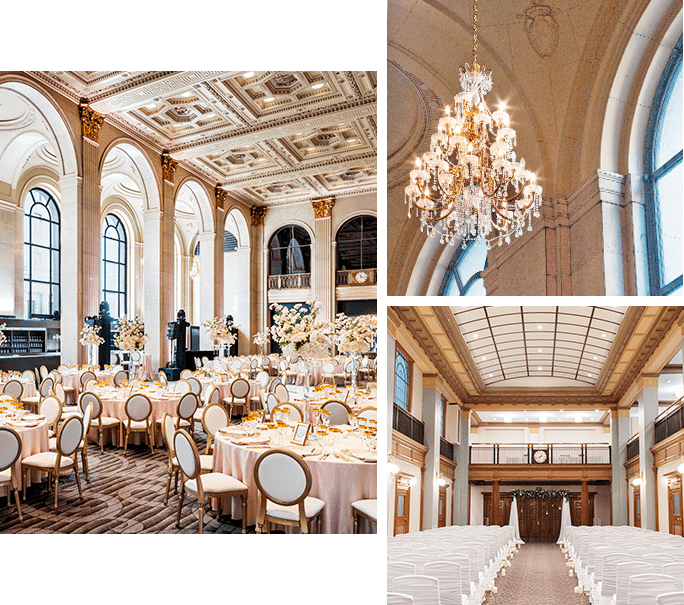

PREMIER TORONTO WEDDING VENUES

The historic core of One King West Hotel & Residence is the Dominion Bank Building. Built in 1914, the beaux-arts style with renaissance revival detailing, creates one of Toronto’s most romantic and stunning wedding venues, that is sure to make your wedding dreams come true.

EXPLORE NOW

PREMIER TORONTO MEETING VENUES

Centrally located in Toronto’s financial district, One King West Hotel & Residence is not only situated in one of the most desired locations in the city, but it also offers the convenience and preferred setting for corporate meetings, receptions, sales events, conferences, training seminars, and Annual General Meetings.

EXPLORE NOW

Downtown Toronto Staycations

Consistently recognized as one of the best and safest cities in the world, make One King West the home base for your Toronto Staycation, and place yourself within walking distance to many of the amazing attractions, restaurants, shops, and historical landmarks that our world class city has to offer.

EXPLORE NOWWHAT'S HAPPENING INSTAGRAM GALLERY

Lounging in style at One King West ✨

Book direct on our website and earn rewards through The Guestbook!

📸: @zaheee22

It’s National Picnic Day! ✨

With the weather warming up, it’s time to start planning your Spring & Summer picnics with our One King West Picnic Package. 🧺 Treat yourself and your companion to an unforgettable day out with all the fixings: fresh summer salad, French baguettes, local cheeses and salumi, decadent desserts and more, all packed up and ready to go in our beautiful classic wicker picnic basket, along with a waterproof blanket. ✨ Once you’ve picked up your prepared basket, you are welcome to head out and find the perfect spot for your picnic with many locations around the city in walking distance from One King West! ☀️ Add a bottle of Prosecco to spritz up your spread or some kid friendly menu items as well for them to enjoy! Click the link in our bio to learn more. Happy Picnicking! 🥂

Credit: @marinarossa

Happy Earth Day! Today and every day, we are committed to sustainability and preserving the environment, from the food we make to the products we use. 🌎 Along with being Green Key Certified, below are some of the many initiatives we take here at One King West Hotel & Residence to respect our planet:

Housekeeping 🧼

✅️Reusable kitchenware in all suites

✅️Towel and robe hooks to promote guest re-use

✅️Eco-friendly in-suite amenity dispensers

✅️Use of environmentally friendly cleaning products and supplies

Energy 💡

✅️Water-saving fixtures in public washrooms

✅️LED lighting in guest corridors

✅️Building automation system for HVAC efficiency

✅️Recycling program

Culinary 👨🍳

✅️Embracing the @100kMFoods program for sustainable, farm-fresh ingredients in all food & beverage programs

✅️Participate in the @toogoodtogo.can initiative to combat food waste and contribute to accessible food options in our local community

✅️Both partners are Certified B Corporations, meaning they meet verified standards for social and environmental responsibility.

From beautiful views to private vows, our Fifteen Hundred is the perfect spot!💍Contact our wedding team at weddings@onekingwest.com to plan your special day!

📸: @morninglightphoto

This week’s Steak Night Friday Feature is a Tajima Australian Wagyu Striploin Steak (10 oz), available today at Teller’s Bistro & Bar from 5:30 PM-9:30 PM✨

Sweet Potato Pavé (Steef Produce Ltd.),

Blue Oyster Mushroom (Hartee Foods),

Cipollini Onions (Cookstown Greens),

Rainbow Carrots (Hillside Garden), Vine Cherry Tomato, Spinach, Green Pea Mousse, Bordelaise Sauce

Treat Mom to a well-deserved getaway with a One King West Hotel & Residence Gift Card! 🌸💌

Take advantage of our Mother’s Day Promotion and purchase an e-gift card worth $50 to $500 maximum & enjoy 20% back automatically applied to your purchase. This offer is valid between April 2nd - May 12th, 2024. Bonus promotional cards are valid for redemption from May 13th, 2024 - December 30th, 2024. Offer available exclusively online through onekingwest.com.

Join us on Sunday, May 12, for Mother's Day Brunch in our illustrious Grand Banking Hall. 🌸 From sweet pastries to savoury breakfast classics, fresh seafood to succulent carved meats, the menu has something for everyone to enjoy! We will be raffling off a luxury CYBEX e-Priam Stroller at the brunch for all who attend. Plus, every booking will receive an exclusive promo code for $200 off CYBEX products at Snuggle Bugz! Click the link in our bio to book your tickets!

Views from our Tower Preferred Suite. ✨

Click the link our bio to book your getaway!

📸: @zaheee22

Celebrate National Eggs Benedict Day at @dailyritual_cafe 🍳✨ Enjoy a delicious breakfast menu, weekdays from 7 AM - 11 AM & weekends from 8 AM - 1 PM!

Celebrate the most cherished women in your life with an unforgettable Mother’s Day Brunch at One King West Hotel & Residence! 🥂🌸

Join us on Sunday, May 12, 2024, and indulge in an elaborate brunch buffet featuring a delectable array of gourmet dishes, from artisanal pastries and savoury breakfast classics to fresh seafood and succulent carved meats, and decadent desserts. 🍳🧁

Click the link in our bio to get your tickets and create loving memories with your family this Mother’s Day! 🤍

Happily Ever After starts at One King West! ✨

Contact our wedding team at weddings@onekingwest.com to get started!

Credit: @north.london.lens

This week’s Steak Night Friday Feature is a Denver Steak (8 oz), available today at Teller’s Bistro & Bar from 5:30 PM-9:30 PM✨

Eggplant Mousse & Cheddar Stuffed Twice Baked Potato, Pink Oysters (Heartee Foods), Honey & Thyme Roasted Atlas Carrots (Ohme Farms), Fires Roasted Peppers (St. David’s Hydroponics), Marinated Graffiti Eggplant (St. David’s Hydroponics), Truffle Au jus

ONE KING WEST HOTEL & RESIDENCE LOCATED IN THE HEART OF TORONTO

-

-

-

1 King Street West, Toronto,

ON, M5H 1A1 -

is accessible

from inside the hotel

-

Approx. 28 km (17 miles)

from Toronto Pearson International Airport

-

Approx. 3 km (1.8 miles)

from Billy Bishop Toronto City Airport